ACCA Vs CPA

ACCA and CPA are the international certification from different certification body of accounting. Both ACCA and CPA are accounting certification and having almost same value and benefits, though both certification may differ in the name of certification body, exam and application process.

ACCA |

CPA |

|

Overview |

ACCA stands for Association of Chartered Certified Accountants offering certified charted accountant (ACCA) certification. | CPA stands for certified public accountant which is the international certification approved by AICPA. |

Approved Body |

ACCA is the international certification body for professional accounting based in UK. | American Institute of Certified Public Accountants (AICPA) is the largest international body for professional accounting and finance in terms of membership and AICPA is based in USA. |

Eligibility |

ACCA eligibility is much lower than CPA. High school graduate is eligible for ACCA certification and no experience needed. | Candidates must have minimum bachelor degree and preferably master degree to fulfill 150 credit hours. |

Exam Level |

ACCA has 14 papers which divided into two levels

1. Fundamental Level (9 Papers) |

You needed to pass 4 papers to become CPA

1. Auditing and Attestation (AUD) |

Exam Type |

ACCA questions are Objective type, longer type and case studies. | Exam question divided into multiple choice, task-based simulations and written communications. |

Exam Timing |

ACCA exam offered in June and December each year. | The entire exam time is 16 hours. Each part has time allocation of 4 hours. You can take 4 papers one at a time or 2 parts at one time or 4 parts at same time. You can sit for an exam any time during first 2 months of every quarter. |

Exemption |

If you have bachelor degree in relevant field, you can apply for exemption for all papers of fundamentals. There is also an exemption if you have done CPA or CMA certification. | No exemptions. |

Application Process |

Apply online accaglobal.com | You can apply through online |

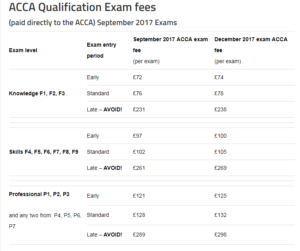

Registration Fees |

Initial registration (A one-time fee that students must pay when registering with ACCA.) £79

Annual subscription (An annual subscription fee is due each year to keep your student status active) £95 Re-registration fee ACCA students who fail to pay fees when due will have their names removed from the ACCA register and must pay a re-registration fee plus any unpaid fees to be reinstated as a student.) £79 |

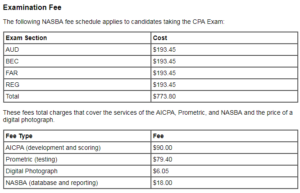

Registration and Exam Fees |

Though both certifications are having some differences in process, exam structure and certification body but both are having their own value and careers benefits. Choosing CPA or ACCA depends on your careers choice, area of work and which country you are working.

EmilySophia

• November 8, 2017The sap classes in dubai is the best..!!